- The Outdoors Crowd

- Posts

- Canyon Bikes (1985), deep-dive into the history

Canyon Bikes (1985), deep-dive into the history

Plus what's the industry talking about on social, and the executive summary of our product pre-validation report.

Hey, Outdoors Crowd.

Happy September to you from Ireland - wherever you’re reading from…

This week:

Social Listening - what’s the outdoors community talking about?

Product Pre-validation Report - Executive Summary - and timeline

Canyon Bicycles: How the company went from a Backyard Workshop to a €800M Global Player

PS - if you’re new here or have been forwarded this email, you can read previous posts and sign up for the newsletter here: https://dereksdeepdive.beehiiv.com/

And please share if you like what we do. It helps enormously to drive down our cost or reader acquisition.

“The clearest way into the Universe is through a forest wilderness" – John Muir

5 Outdoors Industry Trends (Sept 2025)

Heat waves = trail closures

Rising temps push early-morning policies and drive hydration + sun-protection sales.Wildfire smoke & air quality

Cancellations and reschedules are sparking interest in masks, filters, and flexible programming.Participation still growing

181M Americans now outdoors (+3% YoY). Gateway sports like hiking and camping keep leading.Used gear is hot

Trade-in and resale programs expand as value + sustainability resonate with consumers.Price pressure rising

Tariffs and inflation push up retail prices. Brands counter with durability, repair, and perks.

Quick One - have you subscribed to The Overlanding Crowd - our new B2B publication taking deep-dives into the companies behind the Overlanding Revolution? It’s free and boasts 55% open rates every week. Check it out.

Most outdoor product launches fail — here’s how to avoid it

Bringing new gear to market is risky. Development cycles are long, prototypes are expensive, and even strong ideas often fail once they hit the shelves.

This year, we ran a full pre-validation test on a technical jacket project — and the results were eye-opening.

👉 I’ve put together the Executive Summary (free to read on Google Docs) — covering the discoveries, the benchmarks, and the 3 big takeaways for outdoor brands in 2025.

Would you be interested in getting the full Sports & Outdoor Gear Product Validation Report 2025 when it launches?Pricing will start at c.$199, with a discount for our readers. |

Canyon Bicycles: From a Backyard Workshop to a €800M Global Player

canyon.com

In the outdoor industry, few companies illustrate the collision of engineering obsession, digital disruption, and global ambition as clearly as Canyon Bicycles. What started as a small German parts importer in the 1980s is today one of the most influential cycling brands in the world — pushing €800 million in annual revenues, reinventing how bikes are sold, and constantly tweaking the tech that makes pros and weekend warriors alike go faster, further, and longer.

But as Canyon enters 2025, it’s not just a growth story. It’s a case study in founder-led innovation, bold business bets, private equity ownership, and the challenges of scaling in a turbulent industry. It has also been in the news recently, with the founder making a comeback.. Let’s dive in.

Roman Arnold: The Founder Story

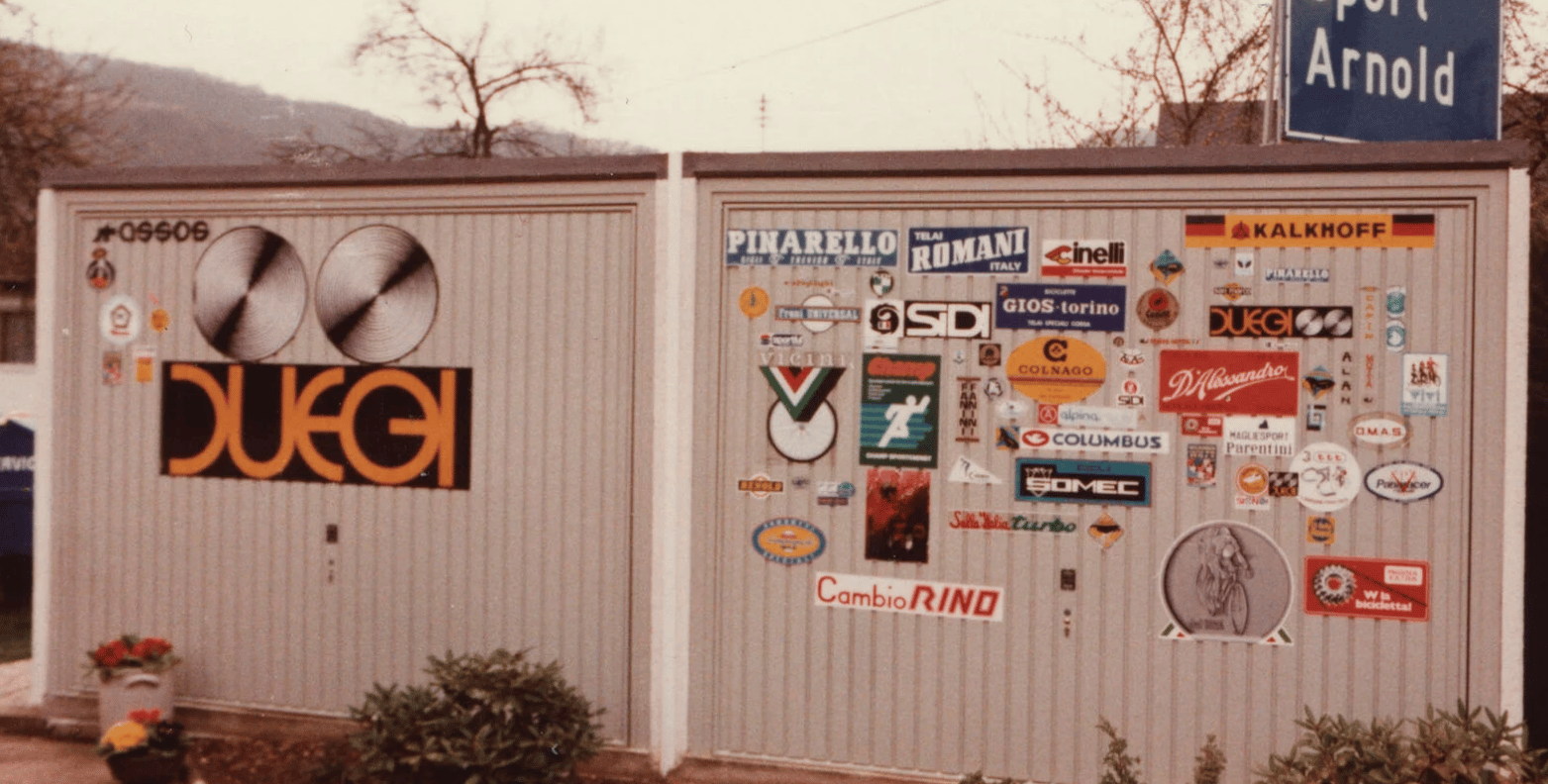

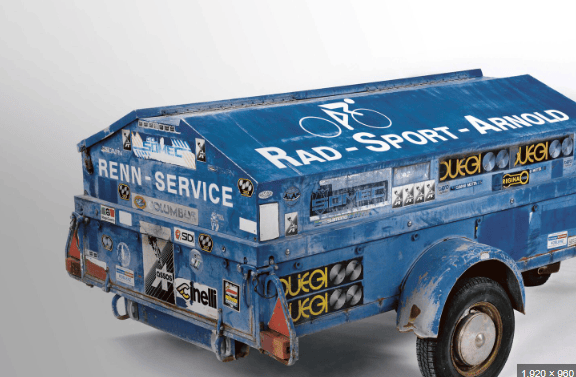

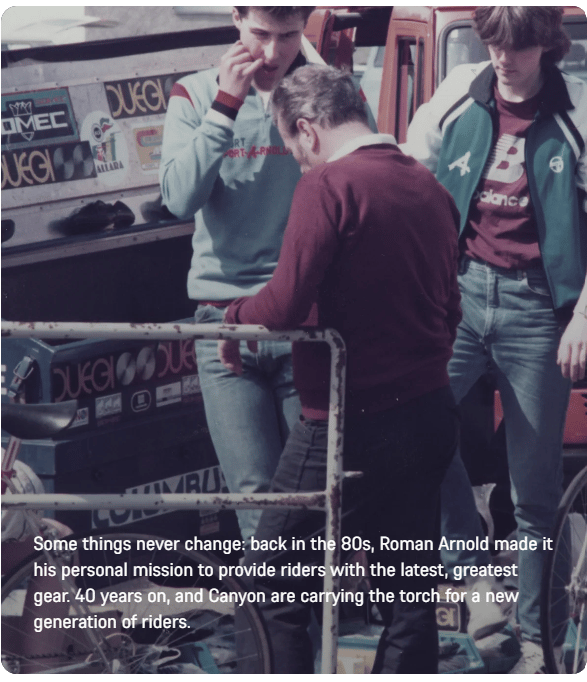

Canyon was born out of the vision of Roman Arnold, a German entrepreneur and lifelong cycling fanatic. In the mid-1980s, Arnold and his brother Frank began importing Italian bike parts and selling them at races from a blue trailer! Their small business was called Radsport Arnold.

Roman quickly noticed that the traditional bike shop model was slow, expensive, and limited in reach. The margins were eaten up by distributors and retailers, leaving little room for innovation or competitive pricing. By the early 1990s, he had a radical idea for the time: skip the dealers entirely and sell bikes directly to consumers.

In 2001, the brothers rebranded as Canyon Bicycles GmbH and launched one of the first direct-to-consumer bike companies in the world. It was a gamble — in an industry where fit, feel, and personal service were sacred — but it gave Canyon pricing power, speed to market, and a direct connection with customers that competitors lacked.

Roman was more than a businessman. He was a tinkerer, constantly working with engineers and pro riders to refine geometry, test carbon layups, and squeeze every possible performance gain out of his bikes. That relentless founder obsession with tech and value became Canyon’s DNA.

Tech as a Differentiator

What made Canyon stand out wasn’t just its sales model. It was the engineering-first approach:

Direct-to-Consumer R&D: Cutting out shops freed up budget to invest in frames, components, and manufacturing tolerances usually reserved for the pro peloton.

Carbon Innovation: Canyon was an early adopter of advanced carbon fiber layup techniques, producing frames that rivaled or exceeded those of boutique Italian brands.

Integrated Design: From cockpit systems to hidden cable routing, Canyon specialized in making bikes look and ride like a unified whole.

Pro Tour Validation: Canyon bikes carried riders to Grand Tour victories, Ironman world championships, and MTB downhill podiums. That credibility filtered down to consumers.

Canyon’s tech story is best summed up by its reputation: race-winning bikes at prices consumers could actually reach.

canyon.com

M&A and Private Equity

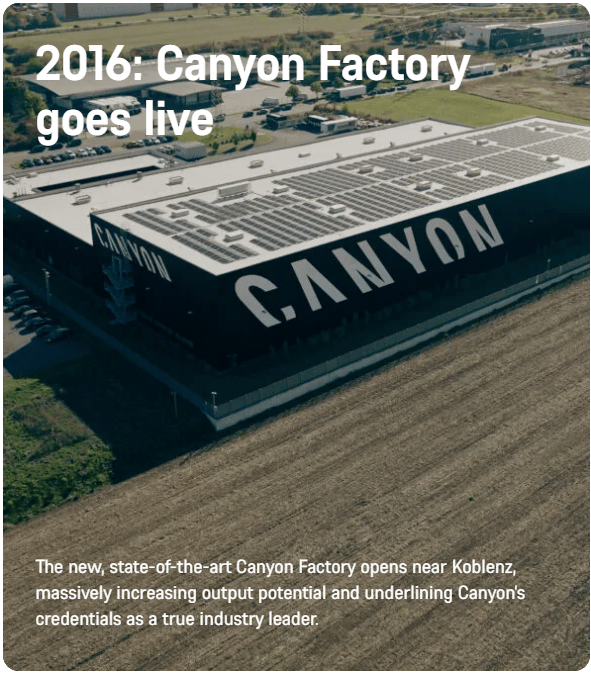

For its first two decades, Canyon was a founder-driven family business. But as revenues surged past €400 million by the late 2010s, Roman knew scaling globally would require outside capital.

In 2020, Canyon sold a majority stake to Groupe Bruxelles Lambert (GBL), a Belgian investment holding company, valuing Canyon at around €800 million. Roman Arnold retained a minority share and became Chairman of the Advisory Board.

The deal provided Canyon with deep pockets for global expansion, logistics, and tech investment. But it also marked a new era: professionalized management, financial accountability, and the classic tension between founder passion and investor returns.

Revenues and Profits: The Big Numbers

Canyon has become one of the largest pure-play cycling companies in the world.

2023: Revenues hit €792 million (~$900M), essentially flat year-over-year, but the company reported a €38 million net loss. Industry-wide discounting and a costly e-MTB battery recall ate into margins.

2024 H1: Sales dipped 5% to €398 million (~$464M). EBITDA fell nearly 30%. Oversupply and high input costs were the culprits. Where have we heard this before???

2025 Outlook: Founder Roman Arnold has stepped back in as Executive Chairman (effective September 2025) to steady the ship and reconnect the brand with its original vision.

In other words: Canyon is massive but facing the same challenges as the entire bike industry — post-pandemic oversupply, rising costs, and slowing consumer demand.

Why Canyon Succeeded

Despite the recent turbulence, Canyon’s success story is undeniable. A few factors explain why it worked:

Direct-to-Consumer Model

At a time when bike brands depended on retailers, Canyon’s decision to go DTC let it control margins, pricing, and customer data. Today, DTC is an industry buzzword — Canyon was decades ahead.Relentless Innovation

Canyon bikes consistently won awards for performance, integration, and value. From the Aeroad road bike to the Spectral MTB, the tech delivered on the hype. Personally, I’m loving the K.I.S tech Keep It Stable)Pro-Level Credibility

Partnering with pro cycling teams and athletes gave Canyon instant legitimacy. Consumers could ride the same frames as Grand Tour winners.Founder Obsession

Roman Arnold was never a distant owner. He was immersed in design reviews, sponsor meetings, and customer conversations. His passion bled into the culture.Scaling Smart

Private equity gave Canyon the capital to build logistics centers in the U.S. and Europe, expand customization, and invest in after-sales service — a weak spot for early DTC brands.

canyon.com

Challenges: Why It’s Tough Now

The flip side of growth is complexity. Canyon faces several hurdles:

Oversupply: Like many bike brands, Canyon overbuilt inventory post-COVID and has struggled with discounting.

Quality Control: Recent e-MTB battery recalls and product issues have dented consumer trust.

Profitability: Flat revenues with losses aren’t sustainable, even at scale. GBL expects returns.

Retail Experimentation: Selling entry-level bikes via Amazon in North America is a major shift. It broadens reach but risks diluting brand cachet.

Competition: Trek, Specialized, and Giant are aggressively pushing into e-bikes and DTC strategies.

Leadership Transitions

The return of Roman Arnold as Executive Chairman in 2025 is a significant development. Investors appear to be signaling that Canyon needs to reconnect with its founder’s clarity and focus. While day-to-day operations remain with CEO Armin Landgraf and the management team, Arnold’s presence provides a symbolic and strategic anchor.

Shop-Eat-Surf

It’s a reminder that, in outdoor and sports industries, founders carry cultural weight — with customers, employees, and the press.

The Road Ahead

For Canyon, the future will hinge on balancing scale with authenticity:

Customization: Programs like MyCanyon, now live in Europe, let riders personalize specs, art, and fit. That’s a smart way to lean into premium margins.

E-Bike Leadership: Canyon has momentum in e-road, e-gravel, and e-MTB — but must fix quality issues and capture trust.

Global Reach: Logistics hubs in the U.S., Europe, and Asia give Canyon unmatched shipping and service capacity.

Lifestyle vs. Performance: The Amazon experiment suggests Canyon may chase volume in urban bikes while retaining prestige in high-end road and MTB. That duality is risky but potentially lucrative.

Timeline Snapshot

1985: Roman & Frank Arnold found Radsport Arnold, selling bike parts.

2001: Canyon Bicycles GmbH officially launched as a direct-to-consumer brand.

2007–2015: Canyon bikes win World Tour and Ironman titles, cementing global credibility.

2020: Majority stake sold to GBL, valuing Canyon at ~€800M.

2023: Revenues €792M; net loss €38M.

2025: Founder Roman Arnold returns as Executive Chairman amid industry headwinds.

Bottom Line

Canyon’s journey is a masterclass in how a founder’s obsession, paired with bold business model innovation, can disrupt an entire industry. From a truckload of Italian parts to an €800M global brand, Roman Arnold proved that skipping the bike shop and going straight to the rider could work at scale. It’s interesting that recent developments show that the newer shareholders have recognized the value in bringing that founder connection back This does not happen often.

Now, the brand faces its steepest climb yet — profitability in a saturated, post-pandemic market. With its founder back in a leadership role, new customization plays, and a loyal rider base, Canyon still has the tools to win. But it will need to balance ambition with execution to stay on top.

For B2B readers, Canyon is more than a bike brand. It’s a case study in how to grow fast, stumble under scale, and then call the founder back to steady the handlebars.

Nice insight here: https://www.youtube.com/watch?v=6PkZphA4rvk

As usual, thanks for reading and I hope you find value in the newsletter. If you do, please share. It helps a lot. Also feel free to reach out directly with any thoughts or feedback (or interests in sponsoring / partnering) at [email protected]

Happy camping.

Until next week, go n-éirí leat!

Derek.