- The Outdoors Crowd

- Posts

- Pivot Cycles (2007), a deep-dive into the company history

Pivot Cycles (2007), a deep-dive into the company history

Success through innovation and solving one problem, really really well.

Hey, Outdoors Crowd.

Into the second week of our campsites here in France. I’ll have a full feedback reports next week. Some really interesting stuff, and some old favorites…

This week we focus on Pivot Cycles - another example of success through innovation and solving one problem, really really well. So an example of being obsessive about product yet again…and reaping the real benefits.

PS - if you’re new here or have been forwarded this email, you can read previous posts and sign up for the newsletter here: https://dereksdeepdive.beehiiv.com/

And please share if you like what we do. It helps enormously to drive down our cost or reader acquisition.

I’ll report back from the campsite to let you know what I’m seeing from from the the business end, through consumer eyes and ears.

“It is not so much for its beauty that the forest makes a claim upon men’s hearts, as for that subtle something, that quality of air that emanation from old trees, that so wonderfully changes and renews a weary spirit.” –Robert Louis Stevenson

Pivot Cycles: Precision Engineering, Founder-Led Focus, and Steady Growth in the Premium MTB Market

Some brands grow out of market analysis. Others grow out of obsession. Pivot Cycles is very much the latter.

Founded in 2007 by Chris Cocalis, Pivot has evolved from a post-Titus startup into one of the most respected names in high-performance mountain biking. The company was built around engineering-led product development, a relentless focus on suspension kinematics, and a hands-on approach to prototyping and R&D. Nearly 20 years later, it’s one of the few mid-sized brands that still builds for serious riders and retains full control of its direction.

In a category crowded by carbon copy frames, Pivot stands apart—not by shouting louder, but by making better bikes.

Founder-Led and Still Deep in the Workshop

Before Pivot, Chris Cocalis was already a well-known figure in the mountain bike world. He’d founded Titus Cycles in the early ’90s and was among the first to bring full-suspension and titanium to market at scale. But after selling Titus, Chris wanted to do it differently—smaller, more focused, more advanced.

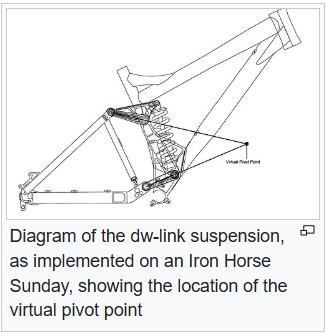

Pivot launched with two models—the Mach 4 and Mach 5—built around DW‑link suspension, a patented design by Dave Weagle that Chris tuned specifically for trail responsiveness and pedaling efficiency. From the start, the bikes stood out for their stiffness, durability, and low-maintenance design.

Fast-forward to today, and Chris still leads product design himself. He rides prototypes, oversees geometry refinements, and signs off on every material spec. The company’s 115-person team in Tempe, Arizona works under the same roof across engineering, marketing, and operations—giving them the agility to move quickly and test in real-world conditions.

That founder-driven continuity is rare—and it’s one reason Pivot’s reputation remains both strong and consistent.

Wiki

Product Strategy: High-Touch, High-Precision, High-End

Pivot is known primarily for premium carbon full-suspension mountain bikes, with pricing typically in the $5,000–$12,000+ range. Their lineup includes cross-country race bikes (Mach 4 SL), enduro/trail platforms (Switchblade, Firebird), DH rigs (Phoenix), and increasingly, a line of eMTBs (Shuttle LT, Shuttle SL). They’ve also expanded into gravel (Vault), commuter/adventure (E‑Vault), and prototype utility formats.

While frames are manufactured in Asia, R&D, prototyping, testing, and full bike assembly are done in Arizona. Pivot’s internal carbon layup testing, CNC machining, and in-house molding capabilities allow them to go from concept to trail-ready frame faster than many competitors.

Every frame is ride-tuned in Arizona terrain—desert, alpine, and flow—and refined through feedback from athletes, shop techs, and customers. This iterative process lets them produce high-precision bikes without overhauling core geometry every season. It’s evolution, not revolution—and it builds long-term rider trust.

They’re also one of the few brands at this scale that continues to offer a lifetime warranty on frames and a courtesy bearing replacement program—valuable retention tools in a high-ticket, high-wear category.

pivotcycles.com

Revenue, Retail Channels, and Margin Strategy

Pivot is a privately held company, but multiple industry estimates put their annual revenue between $25–30 million, with some signals suggesting it could exceed $35M in strong years. That places them in the top tier of independent MTB brands—not boutique, but not mass either.

The company is firmly dealer-focused, with a global network of high-end retailers and specialty shops. Unlike brands pushing direct-to-consumer (DTC) strategies, Pivot has leaned into independent bike dealers (IBDs) as a core advantage. Their build kits, margin structures, and support systems are tailored to help premium retailers succeed—especially those who rely on service, custom builds, and demo experiences.

Pivot also benefits from high average order values and repeat purchasing behavior. Many riders start with a Mach 4 SL or Trail 429, then add a Shuttle e‑MTB or Vault gravel bike. Dealers report strong attachment rates for accessories, frame upgrades, and Pivot-specific components like Tool Dock systems.

With a lean team and low channel complexity, the company maintains healthy margins while retaining flexibility in inventory, forecasting, and dealer allocation.

Innovation and Operational Discipline

Pivot’s growth isn’t fueled by flashy marketing or influencer collabs. It’s built on tight product discipline. Rather than cycling through new SKUs every year, they make incremental improvements to existing platforms and refine them based on field use.

Their in-house testing includes:

CNC prototyping with ultra-fast turnaround

Custom carbon layup testing for stiffness/weight targets

Rigorous ride feedback loops from elite athletes and staff riders

Frame tuning for ride “feel,” not just spec targets

The DW‑link platform remains central to every full-suspension model—allowing Pivot to focus on nuance rather than architecture churn. Geometry changes are conservative and well-tested. This helps retailers avoid old inventory and gives customers confidence their frame won't be outdated in a year.

They’ve also recently invested in a sustainability push, looking at packaging materials, in-shop service kits, and even exploring domestic component sourcing where feasible.

Position in the Market: A Quiet Powerhouse

Pivot’s brand strength comes from doing one thing very well: building ultra-high-quality bikes that don’t break, don’t rattle, and don’t overpromise. This makes them especially valuable to specialty retailers who rely on:

Long product lifecycles

Low warranty issues

Consistent sell-through without discounting

Pivot’s customers are educated, experienced, and not particularly price-sensitive. They’re often second- or third-time buyers—loyal to the brand and willing to spend. For shop owners, this translates into lower acquisition costs, higher LTVs, and easier upsell into accessories and suspension service.

The company’s after-sales support is routinely praised. Tech manuals are clean, warranty support is fast, and communication is clear—rare qualities in high-end MTB retail.

For investors or suppliers, Pivot represents a healthy independent in a consolidating industry—one that’s remained profitable, retained leadership, and expanded methodically without diluting its brand.

Looking Ahead: Where Pivot Is Going

Pivot is not looking to be the biggest. It’s looking to stay focused and exceptional. But they are growing—with key initiatives now including:

Expanded Shuttle eMTB line (lighter weight, integrated battery tech, new motor partnerships)

More gravel and mixed-surface offerings (Vault and E‑Vault)

Improved dealer service programs with streamlined B2B ordering and build kits

Domestic sub-assembly initiative (rumored for 2025) to reduce lead times for North American shops

Selective global expansion—still dealer-first, with strong shop vetting in new markets

Founder Chris Cocalis remains deeply involved. He’s still President & CEO, still riding prototypes, and still leading the charge on the product side. That’s a unique strength—and a reason Pivot has managed to scale without losing its soul.

Final Word: A Case Study in Sustainable Growth

In an industry where brands either go big or get bought, Pivot has found a third path: stay independent, build obsessively, and let the product do the talking.

With ~115 employees, ~$25–30M in annual revenue, global IBD support, and one of the most respected carbon bike lines in the market, Pivot is more than just a successful brand—it’s a template for sustainable growth in premium outdoor gear.

For retailers, it’s a partner that understands margin, product stability, and rider service. For product teams, it’s a case study in iterative innovation. And for founders, it’s a reminder that being deeply involved in your own company’s craft is still a competitive advantage. It’s an example, again, of how to do things right..

As usual, thanks for reading and I hope you find value in the newsletter. If you do, please share. It helps a lot. Also feel free to reach out directly with any thoughts or feedback (or interests in sponsoring / partnering) at [email protected]

Happy camping.

Until next week, go n-éirí leat!

Derek.